Hey there! If you’re reading this, you’re probably in the same boat I am—staring at your tax forms, dreaming of that refund, and wondering, “When will it actually hit my bank account?” I get it completely. That refund isn’t just a number from the IRS; it’s your vacation fund, your chance to finally fix that thing in your house, or a big step toward paying off a nagging bill. The wait can feel like forever, filled with checking your bank app way too often.

Well, take a deep breath. You’ve come to the right place. Let’s walk through the IRS Tax Refund 2026 Schedule together, in plain English. I’ll help you understand how to check your refund amount and, most importantly, how to figure out your exact deposit date.

First Things First: The Golden Rule for a Fast Refund

Let’s be honest: we all want our money fast. The single biggest thing you can do to speed things up is to file your tax return electronically (e-file) and choose direct deposit. It’s like giving the IRS a straight, clear highway to your pocket instead of a bumpy dirt road with a bunch of mailboxes. If you file a clean, error-free return online and opt for direct deposit, you’re in the fastest lane possible.

The IRS officially states that most refunds are issued in less than 21 days. But for e-filers with direct deposit, it’s often much quicker—sometimes even within 10 days! Paper returns? Those can take 6 to 8 weeks, or longer. In 2026, this rule will be truer than ever.

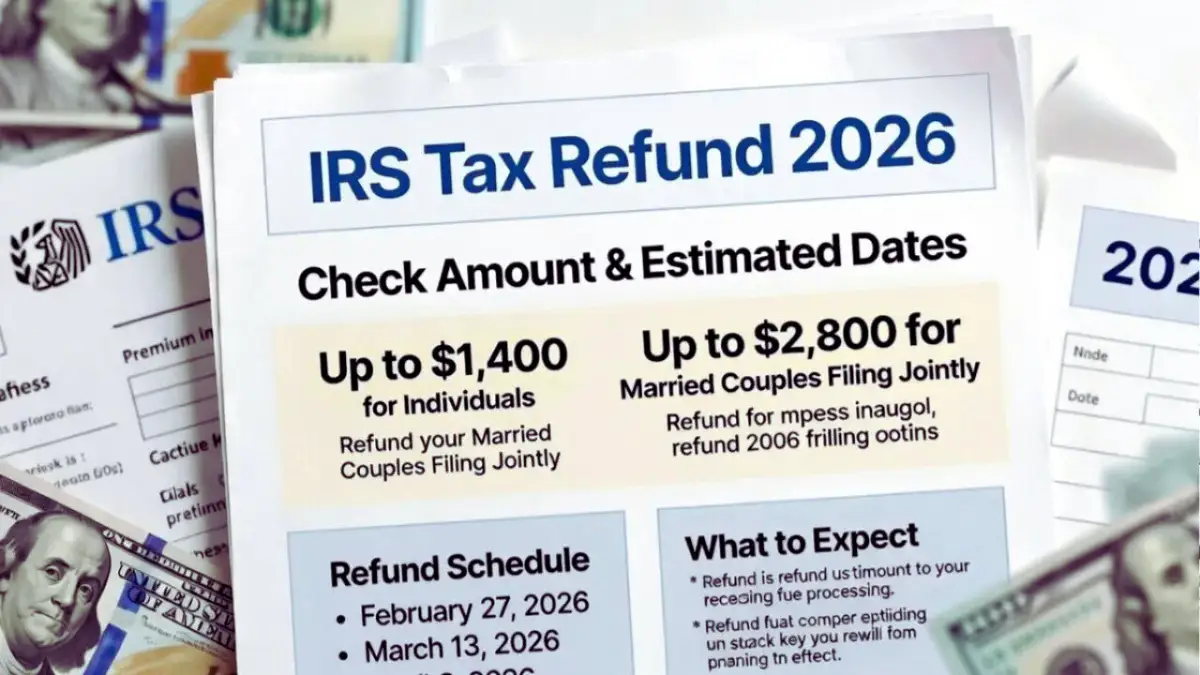

The 2026 IRS Refund Schedule: Key Dates to Circle on Your Calendar

While the IRS doesn’t give a single “payday” for everyone, they follow a strict internal schedule based on when you file. Here’s the general timeline you can expect in 2026:

- Mid-January 2026: The IRS begins accepting and processing 2025 tax year returns. (Yes, we file in 2026 for the 2025 year—it’s confusing, I know!).

- January 20, 2026 (Approximate): This is typically the date when the IRS starts issuing refunds for returns with the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC). Due to a law called the PATH Act, the IRS must hold these refunds until at least this date, even if they processed your return earlier. It’s to help prevent fraud. If you claim these credits, don’t expect your refund before mid-February.

- April 15, 2026: The big deadline! This is Tax Day for most people.

- October 15, 2026: The last day to file if you requested an extension.

Remember: Your personal “schedule” starts the day the IRS accepts your return, not the day you hit “submit.”

How to Check Your 2026 Refund Status & Amount in Real-Time

This is the best part—you don’t have to guess! The IRS has a fantastic, free tool that takes the anxiety out of waiting.

- Gather Your Info: You’ll need your Social Security Number (or ITIN), your filing status (like “Single” or “Married Filing Jointly”), and the exact refund amount you are expecting from your tax return. Having the exact number is crucial!

- Visit the IRS “Where’s My Refund?” Tool: Head to the IRS website and search for “Where’s My Refund?” or go directly to the secure tool. You can also use the IRS2Go mobile app. It’s safe, it’s easy, and it’s updated daily.

- Read the Bars: The tool will show you a simple progress bar:

- Return Received: The IRS has your return.

- Refund Approved: They’ve processed it and are preparing your refund.

- Refund Sent: Your money is on its way! It will tell you if it’s a direct deposit or a mailed check and give you an exact deposit date.

I check this tool once a day after I file. Seeing that bar move from “Received” to “Approved” is a fantastic feeling—it’s like a little digital high-five!

What’s the Hold-Up? Common Reasons for a Delayed Refund

Sometimes, the 21-day clock feels like it’s ticking backward. If it’s taking longer, don’t panic. It could be because:

- Errors on your return: A mistyped SSN or a math error will slow things down.

- Incomplete information: Forgetting to sign or date a form.

- Identity verification: The IRS might need to confirm it was really you who filed.

- Claiming certain credits: As mentioned, the EITC/ACTC PATH Act hold means a refund won’t come before mid-February.

- Your return needs further review: This can happen for various reasons, often random.

If the “Where’s My Refund?” tool asks for more information or shows a message beyond the normal bars, just follow its instructions. It’s your best guide.

A Little Emotional Advice From Someone Who’s Been There

I remember one year, I was counting on my refund by a certain date for a car repair. The days kept passing, and nothing. I was stressed, checking my account constantly, getting frustrated. The lesson I learned? Try not to plan major, time-sensitive expenses around your refund until it’s physically in your account. The IRS is dealing with tens of millions of returns. Treat a fast refund as a happy surprise, not a guaranteed event.

Use the tools, know the schedule, and then—as hard as it is—try to distract yourself. That money is coming. You did the work of filing, and now it’s just about the system running its course.

Your 2026 Refund Action Plan

- File early and e-file with direct deposit.

- Mark the key dates from above on your calendar.

- Use the “Where’s My Refund?” tool 24 hours after e-filing (or 4 weeks after mailing a paper return).

- Have your exact refund amount handy when you check.

- Breathe. Use the daily updates for peace of mind, not for extra stress.

Getting your tax refund should feel like a reward, not a mystery. By understanding the IRS Tax Refund 2026 schedule and using the official tools, you’re taking control of the process. Now go on, get that return filed, and get in line for your money. You’ve got this!

P.S. Always make sure you’re on the official IRS.gov website for tools and information to protect yourself from scams. The IRS will never initiate contact about your refund via email, text, or social media. Stay safe!