Let’s be honest. The idea of retirement isn’t what it used to be. Maybe you dream of finally opening that small Etsy shop, or picking up part-time shifts at the local garden center, or just keeping your hand in the work you love—but without the 40-hour grind. You want that Social Security check, but you also want, or maybe need, a paycheck.

If that’s you, you’ve probably heard the scary stories: “If you work, they’ll take your benefits!” It’s a huge source of stress and confusion. I’ve watched friends agonize over this decision, terrified of making a wrong move.

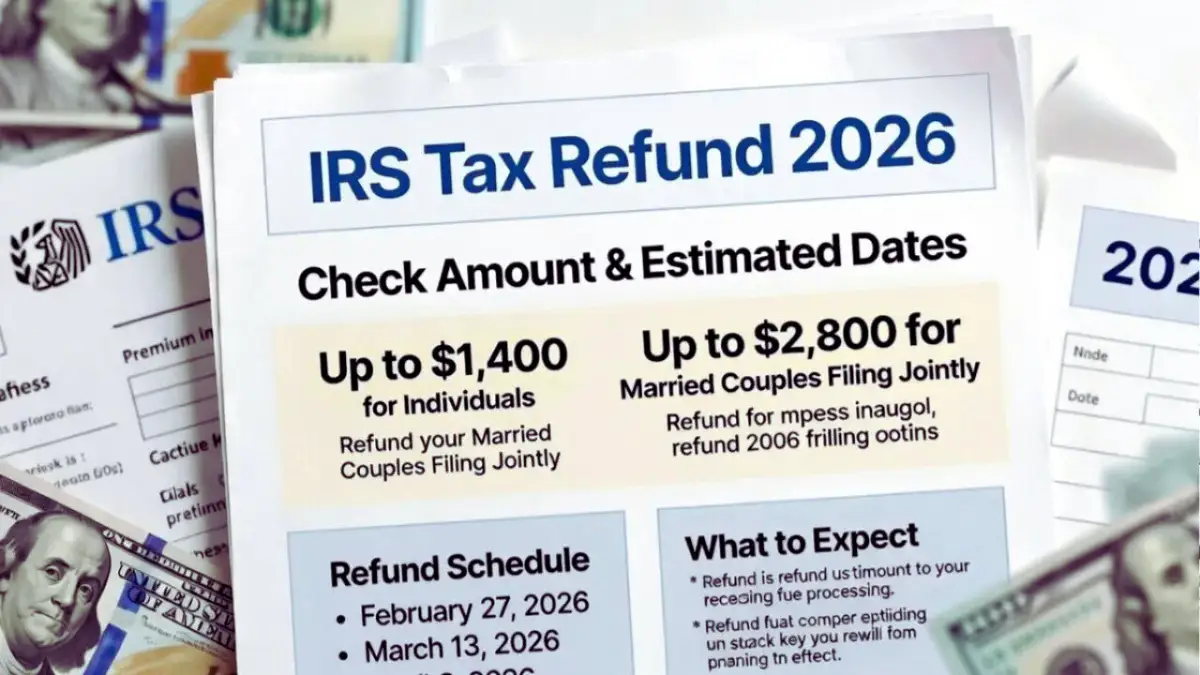

Well, big news: Starting in 2026, the rules are changing. And for many, it’s a change for the better. Let’s walk through what the New Social Security Rules 2026 mean for your plans to work while taking benefits. I’ll break it down in plain English, just like I did for my own mom.

The Old Rules (The “Earnings Test” Boogeyman)

First, a quick look back. Before 2026, if you started taking Social Security before your Full Retirement Age (FRA—that’s 67 for most of us now) and kept working, you faced the “Retirement Earnings Test.”

Here’s how it worked:

- There was a yearly earnings limit (about $22,320 in 2024).

- If you earned more than that, Social Security would withhold $1 in benefits for every $2 you earned over the limit.

It felt like a punishment. You’d get a letter saying benefits were withheld, and honestly, it made people feel like they’d done something wrong. They hadn’t! That money wasn’t lost forever—it was later factored in when you hit your FRA, essentially giving you a higher monthly benefit later. But the immediate sting, the bureaucracy of it… it was discouraging.

The 2026 Change: A Big Step Toward Simplicity

The Bipartisan Budget Act of 2025 (passed in late 2024) brought a key update that kicks in for 2026.

Here’s the core change: The earnings limits are going up—significantly.

While the exact 2026 numbers won’t be set until late 2025 (they’re adjusted for inflation), the formula change means the limit will be much higher. Experts project it could be near $24,000 for people under their FRA for the full year, and about $63,000 in the year you reach your FRA.

Why does this matter?

It means more breathing room. That part-time job, the consulting gig, the seasonal work—it’s less likely to trigger any benefit withholding. For countless people, this removes a massive mental barrier to working. It acknowledges a simple truth: Working in early “retirement” is normal, common, and often financially necessary.

What Happens If You Do Earn Over the Limit in 2026?

Let’s be clear: The Earnings Test isn’t gone. It still applies if you take benefits before your FRA. But with the higher limit, fewer people will hit it.

If your earnings do exceed the new, higher 2026 limit:

- Social Security will still withhold $1 for every $2 you earn over the limit (if you’re under FRA for the whole year).

- They will estimate this at the start of the year if you report expected earnings, or withhold benefits mid-year if your earnings surprise you.

- Crucially, you are still made whole later. Once you hit your Full Retirement Age, Social Security recalculates your benefit amount to account for the months where benefits were withheld. Your monthly check will go up permanently.

Think of it not as a tax, but as a forced delay of benefits. It’s clunky and can be a cash-flow headache, but it’s not a penalty in the long run.

The Golden Rule They NEVER Tell You (The Most Important Part!)

All this talk about working before your FRA leads me to the most emotional part of this whole puzzle. My dad missed this, and it cost him.

The single biggest factor in your Social Security benefit amount is when you choose to start it.

- Take it at 62 (the earliest): You get a permanently reduced check.

- Take it at your Full Retirement Age (e.g., 67): You get 100% of your earned benefit.

- Delay it past your FRA, up to age 70: Your benefit grows by about 8% per year. That’s guaranteed growth you can’t find anywhere else.

Here’s the personal truth: If you work and your benefits are withheld because of the earnings test, you’re often functionally doing the same thing as delaying your claim—and getting that higher benefit later. But if you work and can afford to not take Social Security at all until later, you win exponentially. Your benefit keeps growing, and you keep 100% of your paycheck.

It’s a brutal math vs. life equation. Sometimes you need that Social Security money now to survive. I get that. But if you have any other option—savings, a spouse’s income, part-time work—delaying your claim is the most powerful financial lever you have for the rest of your life, and for a surviving spouse.

Your Action Plan for 2026 and Beyond

- Know Your Full Retirement Age. It’s your north star. Find it on the SSA website.

- Estimate Your 2026 Work Earnings. Be realistic. Will you be near the new, higher limit?

- Use the SSA’s Tools. Before you claim, use their online calculators. The “My Social Security” portal lets you see estimates based on different claiming ages.

- Consider the Long Game. Have a family money talk. Is claiming early essential, or is it a choice? Could working longer (even part-time) to delay claiming supercharge your lifelong income?

- Report Accurately. If you do work and take benefits, report your earnings estimate honestly to SSA. It avoids nasty surprise bills later.

A Final, Human Thought

The New Social Security Rules 2026 for working while taking benefits are a recognition. They recognize that our lives aren’t binary—we don’t just flip a switch from “worker” to “retiree.” This change offers a bit more freedom, a bit less fear.

But please, look beyond the earnings test. The biggest decision you’ll make isn’t about a part-time job in 2026; it’s about the age on the application you submit. That choice echoes for decades. Make it with your eyes wide open, with as much information as you can, and with kindness to your future self.

You’ve worked hard for these benefits. Now, let’s make sure they work just as hard for you.

This post is based on current law and projections. Always check the official Social Security Administration website (ssa.gov) for the most current figures and rules, and consider speaking with a financial advisor for personal guidance.