With the growing popularity of electric vehicles (EVs), governments at both the federal and state levels have introduced various incentives to encourage their adoption. While the federal tax credit for EVs has been extended through 2032, there are also significant state-level benefits and rebates available for EV owners. In this blog post, we’ll explore some of the state tax benefits and rebates for electric vehicles across different states in the United States.

Federal Tax Credit Limitations: Before delving into state-specific incentives, it’s important to note that the federal tax credit for personal-use electric vehicles is subject to strict domestic sourcing rules for batteries. This means that not all electric vehicles will qualify for the full $7,500 federal tax credit. However, for the vehicles that do qualify, you can refer to the latest information from the IRS regarding tax credits for electric vehicles.

State Incentives: In addition to the federal tax credit, most states offer their own incentives to residents who transition from traditional gasoline-powered vehicles to electric vehicles. These incentives vary from state to state and can include:

- Reduced vehicle licensing fees or sales taxes.

- Access to state High Occupancy Vehicle (HOV) lanes even without additional passengers.

- Reduced or waived vehicle inspections.

- Financial incentives for purchasing home chargers.

- Utility company rebates for electric vehicle purchases.

Statewide Financial Incentives: Eight states have gone a step further by offering their own statewide financial incentives in the form of rebates to residents who purchase or lease electric vehicles. While these rebates are generally smaller than the maximum federal tax credit, they can still range from $1,000 to $2,000 in most states and even reach up to $7,500 for lower-income residents. It’s important to note that these state rebates are typically available for both individuals and businesses.

Eligibility Requirements: To qualify for state rebates, you must be a resident of the state and continue to reside there for a specific period after purchasing or leasing your electric vehicle. Additionally, many states have income caps, which may be lower than the federal income caps. Therefore, it’s essential to thoroughly review your state’s program requirements before making an electric vehicle purchase.

State-Specific Summary: Here is a summary of the state tax benefits and rebates available for electric vehicles in the 8 states offering incentives:

- California: The Clean Vehicle Rebate Project offers a tax rebate based on the type of zero-emission vehicle and the resident’s household income. The rebate amounts vary, and there are income caps for eligibility.

- Colorado: Colorado offers a non-refundable state tax credit for purchasing or leasing electric vehicles, with varying credit amounts based on the vehicle’s weight rating.

- Connecticut: The Connecticut Hydrogen and Electric Automobile Purchase Rebate provides standard rebates for eligible vehicles, with additional rebates available for lower-income residents.

- Maine: Maine offers point-of-sale rebates for eligible battery electric vehicles and plug-in hybrid electric vehicles, with different rebate amounts based on income levels.

- Maryland: Starting from July 1, 2023, Maryland residents can qualify for a $3,000 excise tax credit for zero-emission plug-in electric or fuel cell electric vehicles.

- Massachusetts: Massachusetts provides rebates through the MOR-EV program for qualifying electric vehicles, with varying rebate amounts based on the vehicle’s classification and sales price.

- New York: New York offers a Drive Clean Rebate for eligible residents based on the electric range of the vehicle.

- Pennsylvania: Pennsylvania offers rebates for lower-income residents who purchase or lease battery electric vehicles, plug-in hybrid electric vehicles, or fuel cell vehicles.

State-By-State Details: Is your state on the list above? See below for more info about each state’s EV incentives and how to qualify:

California

California offers a tax rebate to residents who purchase or lease (for at least 30 months) new zero-emission vehicles. These include battery electric vehicles, plug-in hybrid electric vehicles, fuel cell electric vehicles, and zero-emission motorcycles.

This tax rebate is known as the Clean Vehicle Rebate Project and is administered by the California Air Resources Board. The amount of the rebate varies depending on the type of zero-emission vehicle and on the individual resident’s household income. There is also an income cap on the credit, which is substantially lower than the cap for the federal credit.

The maximum income eligibility levels to qualify for a California rebate are as follows:

– $135,000 for single filers

– $175,000 for head-of-household filers

– $200,000 for joint filers

The income caps apply to all zero-emission vehicles except fuel cell vehicles.

Business and nonprofit purchasers or lessors are not subject to the income limits.

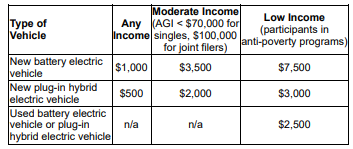

There is a standard rebate amount plus an additional rebate for lower-income individuals—individual purchasers or lessors with household income of less than 400 percent of the federal poverty level. For example, a California single taxpayer with an income of no more than $58,380 can qualify for a $7,500 rebate if he or she purchases a battery electric vehicle, or $6,500 for a plug-in hybrid vehicle.

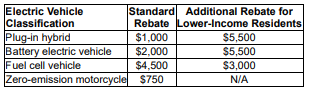

The amount of the rebate is shown in the following chart:

Business and individual purchasers or lessors may receive only one clean vehicle rebate.

To qualify for the rebate, the vehicle must have a base manufactured suggested retail price (MSRP) of

– $60,000 or less for large vehicles (including minivans, pickups, and SUVs), or

– $45,000 or less for cars and light-duty vehicles (hatchbacks, sedans, wagons, and two-seaters).

To apply for the tax rebate, the purchaser or lessor must submit an online application through the Clean Vehicle Rebate Project website within three months of the purchase or lease date. The application requires proof of purchase or lease, proof of California residency, and proof of income.

For a list of qualifying vehicles, click here: https://cleanvehiclerebate.org/en/eligible-vehicles

Colorado

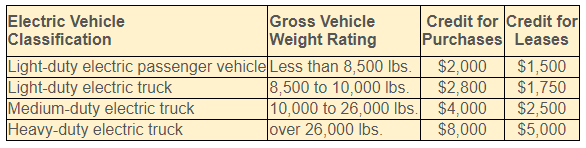

Colorado offers a non-refundable state tax credit to taxpayers who purchase or lease a new electric vehicle or plugin hybrid electric vehicle and then register it in the state. The amount of the credit for electric vehicles purchased or leased during 2023 through 2025 is shown in the following chart:

Leases must be for a minimum of two years. But if you terminate the lease early, you retain your full credit.

The credit may be claimed for each electric vehicle a taxpayer purchases or leases. There is no limit on the number of credits that may be claimed each year.

This is a refundable state income tax credit, not a rebate. If the credit exceeds the taxpayer’s Colorado income tax liability, the excess is refunded to the taxpayer.

To claim the tax credit, taxpayers must complete Form DR 0617, Innovative Motor Vehicle Tax Credit Schedule, and submit it with their Colorado state income tax return. The form requires taxpayers to provide information about the make and model of the vehicle, the date of purchase or lease, and the amount of the tax credit claimed.

Connecticut

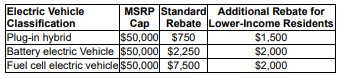

The Connecticut Hydrogen and Electric Automobile Purchase Rebate offers incentives to Connecticut residents who purchase or lease an eligible vehicle from a licensed Connecticut automobile dealer.

As shown in the following chart, a standard rebate amount is obtained by purchasers or lessors directly at the dealership. Lower-income residents may claim an additional rebate from the state.

Lower-income purchasers or lessors must meet one of the following criteria:

– Reside in an environmental justice community or a distressed municipality.

– Participate in a qualifying state or federal income program.

– Have income of less than 300 percent of the federal poverty level.

For a list of qualifying vehicles, click here: https://portal.ct.gov/DEEP/Air/Mobile-Sources/CHEAPR/CHEAPR—New-Eligible-Vehicles

Maine

Maine offers a rebate to state residents who purchase or lease (for at least 36 months) eligible battery electric vehicles or plug-in hybrid electric vehicles. This point-of-sale rebate is scheduled to end December 31, 2023.

The amount of the rebate varies with purchasers’ or lessors’ income, as shown below:

The rebates are limited to two per customer in a 12-month period. For moderate- and low-income households, they are limited to one per customer and two per household.

Maine businesses may claim a rebate of $2,000 for battery electric vehicles and $1,000 for plug-in electric vehicles. Businesses are limited to 10 rebates in a 12-month period.

The rebates are available for electric vehicles with the following MSRPs:

– $73,000 for pickup trucks or commercial vans with a range of 300 miles or more, as rated by the U.S. Environmental Protection Agency (EPA);

– $65,000 for pickup trucks or commercial vans with an EPA-rated range of less than 300 miles; or

– $50,000 for all other eligible vehicles.

For a list of eligible vehicles, click here: https://www.efficiencymaine.com/docs/EV_Rebate_Eligible_Vehicles.pdf

Maryland

Beginning July 1, 2023, purchasers or lessors of zero-emission plug-in electric or fuel cell electric vehicles can qualify for a $3,000 Maryland excise tax credit. The tax credit is first-come, first-served, and is limited to one vehicle per individual and 10 vehicles per business.

To obtain the credit, vehicles must meet the following criteria:

– Have a total purchase price not exceeding $50,000.

– Be propelled to a significant extent by an electric motor that draws electricity from a battery with a capacity of at least 4 kilowatt-hours.

– Be unmodified from original manufacturer specifications.

– Be purchased and titled for the first time between July 1, 2023, and July 1, 2027.

A $1,000 credit is available for zero-emission motorcycles ($2,000 for three-wheeled motorcycles).

Massachusetts

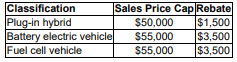

Massachusetts has a Massachusetts Offers Rebates for Electric Vehicles (MOR-EV) program that provides rebates to Massachusetts residents who purchase or lease (for at least 36 months) battery electric vehicles, plug-in hybrid electric vehicles, or fuel cell electric vehicles. The rebate amounts are as follows:

The state anticipates phasing out rebates for plug-in hybrid vehicles in the spring of 2023. Currently, purchasers or lessors must apply for their rebate to MOR-EV through its website. But MOR-EV anticipates initiating a point-of-sale rebate program, also in the spring of 2023.

Eligible vehicles purchased or leased outside of Massachusetts are eligible for a rebate as long as the vehicle is registered in Massachusetts within 90 days of the vehicle purchase date. For a list of eligible vehicles, see: https://mor-ev.org/eligible-vehicles

New Jersey

The Charge Up New Jersey program to incentivize electric vehicles has paused as of April 17, 2023. Dealerships and showrooms had until 9:00 p.m. Eastern time on Monday, May 1, 2023, to enter all eligible orders from July 25, 2022, to April 17, 2023.

Currently, no additional funds are anticipated for fiscal year 2023

New York

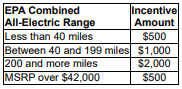

New York offers a Drive Clean Rebate for state residents who purchase or lease (for at least 36 months) battery electric vehicles, plug-in hybrid electric vehicles, or fuel cell electric vehicles that weigh less than 8,500 pounds. This is a point-of-sale rebate obtained directly from the dealership.

New York’s rebate is based on the electric range as determined by the EPA, as follows:

For a list of eligible vehicles, click here: https://www.nyserda.ny.gov/All-Programs/Drive-Clean-Rebate-For-Electric-Cars-Program/How-it-Works/Eligible-Models

Pennsylvania

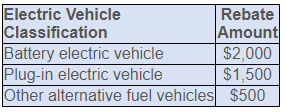

Pennsylvania has a rebate program for lower-income residents who purchase or lease battery electric vehicles, plug-in hybrid electric vehicles, or other alternative-fuel vehicles, including electric motorcycles.

Pennsylvania limits the rebate to its residents whose household income is less than 400 percent of the federal poverty level. This greatly limits the rebate’s availability.

For example, a family of two must have an income of no more than $73,240 to qualify for a rebate, while a single resident can have income of up to $54,360. There is no rebate for businesses.

Pennsylvanians with income of less than 200 percent of the federal poverty level get an extra $1,000 rebate.

The rebate is available for new electric vehicles with a purchase price of $50,000 or less. Used electric vehicles that cost up to $50,000 and are up to seven years old with no more than 75,000 miles on the odometer also qualify for the rebate. Used electric vehicles must be purchased from a dealer.

This rebate is scheduled to expire June 30, 2023.

Takeaways:

Eight states offer tax rebates or credits to residents who purchase or lease electric vehicles. These include California, Colorado, Connecticut, Maine, Maryland, Massachusetts, New York, and Pennsylvania. You can collect state credits and rebates in addition to the federal tax credit. In many cases, the credits are available for electric vehicles that don’t qualify for the federal credit because of strict domestic sourcing rules for batteries. Many of the eight states that offer rebates impose income restrictions to qualify for a rebate as well as price

restrictions on qualifying electric vehicles. You must be a state resident to qualify for a state electric vehicle rebate, and you must continue to reside in the state for two or three years (depending on the state) after you purchase or lease your electric vehicle.